Monthly Budget Ideas: Template and Strategies to Stay on Track

Monthly budget template to help you stay on financial track! These budgeting tips for families are simple to implement and can make a huge difference to your budget!

Within the past few months, I've had a conversation with multiple people about budgeting. I don't think I'm an expert by any means, but we've been through a big debt payoff, a job loss, and other financial circumstances, and have managed by having a monthly budget in place.

Keep it Simple (KISS)

The advice I give to everyone starts with simplicity. Keep all your bills on a spreadsheet or in a notebook. List the name, due date and amount; you can add other information if you need it. Pay attention to the due dates so you never miss a payment and incur late fees.

I will be honest and say that I've paid more than my fair share of late fees. Not because we had insufficient funds, but because I was busy with so many other things. Consider adding items to a calendar so this doesn't happen to you.

Create a Bill Paying Process

Pay all your monthly bills that have a fixed amount like your rent or mortgage first and then go in and pay your other monthly bills. Fixed bills are usually the most expensive and are always due on the same day every month. We have the fixed bills set to auto-pay which is super convenient if your online bill pay/bank offers this.

Pay your other monthly bills by the due date and in the order of importance. For instance, pay the electric bill before paying the cable bill. If something should go wrong, you at least have heat and lights. And if you're in debt payoff mode, just cancel the cable all together. There are lots of ways you can watch TV for free.

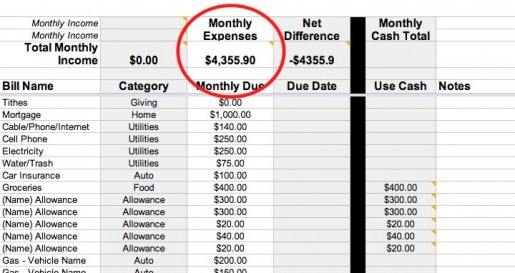

Use a Budget Template

I created a budget template (pictured above) years ago that my husband and I still follow to this day! This is the definition of KISS above! Following a template like this is the sole reason we have been able to eliminate nearly $200,000 in debt through the years! I also happen to love Google Sheets so having it readily available for the both of us to look at whenever we have questions, makes it easy to be on the same page at all times. Sign up on the form below to get the template sent to your email.

Arrange any Overdue Payments

If for some reason you cannot pay a bill when it is due, don’t throw it aside and pretend it’s not there. Call the company and make arrangements to get it paid as soon as you can. The last thing you need is to have a bill turned over to collections, especially if you can make payment arrangements.

Create a Filing System

File your receipts as you go. Make files for all your categories like medical, donations and the like. After you pay the bill, put the receipts into the appropriate file folder. This only takes a few minutes and saves quite a bit of time come tax time.

While you are paying bills, it is a good time to sort receipts for items you may have purchased that month. File receipts alphabetically so you have instant access to them incase you need to use a warranty or return an item to the store.

Setting up your filing system and your account log whether it is on your computer or hard copy, takes time so definitely download the budgeting spreadsheet above to help in that department. Start now to get those files ready so you can make paying your next round of bills a little easier.

What budgeting tips do you have?

More Articles on How to Budget

52 Week Money Challenge Excel Template

Envelope Method of Budgeting: The Cash Envelope System Explained