Cash Budget: Format and Example including a Hybrid Approach

Not everyone knows how to start a budget, let alone a cash budget. The good news is that it’s very easy to start a cash budget.

This cash budget example is a step-by-step guide. The true measure of your success will be applying the cash budget format consistently within your budget. Consistency truly will help you realize the amazing potential of a cash budget system!

What is Cash Budget

Here is how to start a cash budget. First, know what a budget is. A budget isn’t a way for you to feel cheated out of your own money. Instead, a budget is a great way for you to tell your money where to go.

So many of us get caught up in spending money that it’s gone before you know it. A budget is just a way of telling each dollar you have where to go. With a cash budget, you are simply using cash only for expenses.

Cash Budget Format

Know you’ll be using cash with each purchase possible. In today’s electronic world, using cash can seem weird. However, cash is going to spend a lot differently than debit/credit.

The key to using cash is to commit to using it. It can be easy to whip out that credit or debit card. However, once you get used to it, you’ll love it.

My debit card wasn't working recently. I knew there was money in my account, however the card reader wasn't processing my card for some reason. I jokingly said, “Well, I guess that's why I should have had cash on me.” Paying cash can help save time in the long run!

Cash Budget Flow

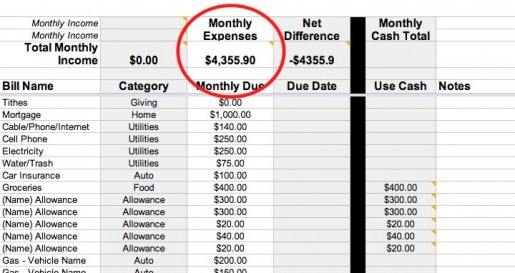

To get your cash budget rolling, you need to know what’s coming in and what’s going out. This is really going to help you get your cash budget started.

To get into a cash budget flow, make a list of all your expenses and make a list of your income. If you have more bills than income, you need to figure out a way to cut back on the spending or increase your income.

Cash Budget Envelopes

Most people get paid weekly or bi-weekly. You can start creating your cash budget with basic white envelopes. However, there is psychology behind the “beauty” in something you will interact with on a daily basis so splurge for nicer envelopes if you want (these are cute).

No matter what type of envelopes you use, just make sure you're adding cash to them as scheduled. That will be the key to making the cash budget a success!

Cash Budget Example

Since you know what everything costs and how much money you have coming in, this should be easy. Now you need to grab your envelopes and write out how much you have budgeted for each category.

An example would be:

- $100 for groceries for the week

- $50 for gas for the week

- $50 for child activities for the week

You write the amount that is budgeted on the outside of the envelope and then you put that amount inside of the envelope. When you need money for the category, you simply go to that envelope.

Once the money is gone, it’s gone. You can’t borrow from another envelope to pay something else. This helps keep you on task, budget wise!

Cash Budget and Paying Bills Online (Hybrid)

Sometimes it's smarter to pay for your bills online rather than taking out cash for an envelope each week. I do a hybrid envelope system for those types of bills. This is my exact process:

- Payment deposited to personal checking account.

- Automatic transfer setup to take a portion of payment and deposit to savings (to cover online bills).

- When online bill is due, automatic transfer back to our personal checking account exactly 1 day before that bill is due.

- Online bills are paid.

Monthly set bills, like our mortgage and cell phone bill, are setup on auto-pay from our checking account. So the auto transfers from our checking to saving and back saves me so much time and ensures that the budget is always followed! Doing this also helps to make it seem less strict *now* and helps ensure we are saving more too.

Cash Budget Problems

Know that your budget may need changed every week or month. Have a budgeting meeting with your spouse is also a good idea.

Being on the same page financially is going to help you create that cash budget and stick to it! When everyone in the family understands the goals, it helps make things go so much more smoothly! It wasn't always sunshine and roses for us, especially at the beginning (and sometimes it still isn't)! We found that by discussing the budget it helped mitigate any frustration.

What is the Main Purpose of Preparing a Cash Budget

A big purpose of preparing a cash budget is that you can stop using all credit cards. You don’t want to get caught up in using credit anymore.

I've seen so many people get debt paid off only to be back into debt again because credit cards are used. A cash budget that is created – and modified as necessary – can help to prevent this! A cash budget can also help you save more each month too!

When you know where your money is going – and physically seeing the greenbacks leave your hand – it makes it more of a reality. Ditching debt and saving for your future or a goal (like a vacation, college education, etc) is so rewarding!

More Posts on Budgeting