Ideas to Make Your Paycheck Last Longer

Last updated: October 1, 2017

We have gone from being paid every week to strictly on a monthly basis. I don't care how much money you bring in each month, it is an adjustment going to a monthly bank deposit. I prefer monthly pay now since I can pay all of our expenses at once and know the money is there to cover everything.

If you want some ideas to stretch your paycheck each month, here are a few things we have personally done to adjust our mindset and bank balance:

Adjust Tax Withholdings

If it has been a few years since you began working for your current employer, it may be time for an update on your W-4 form. You may have claimed zero so you wouldn’t owe taxes at the end of the year, but this may no longer be a wise choice. If you start claiming more exemptions, you will have less money withheld from your paycheck and *theoretically* more in your pocket, plus money back come tax day.

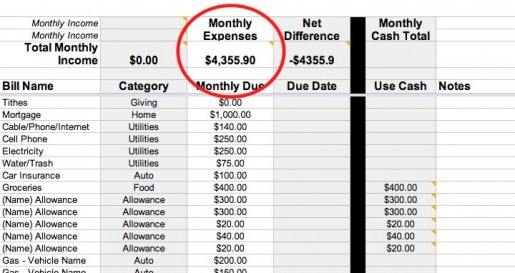

Download the free budgeting spreadsheet our family uses here.

Create a Daily Budget

On payday spend your money like you don’t have any. Pay the bills that are due, add to your savings, and buy groceries of course. With the left over money you need to budget it carefully, and here is how:

Divide the lump sum by the amount of days left until payday. That is how much you can spend a day. If you have $200 dollars left and you have 12 days until payday, you can spend around $16 dollars a day. If you spend only $10 of that money a day, you have $72 left come your next payday. Save that money every month and you have Christmas paid for!

Save more with the 52-week savings challenge (includes a spreadsheet).

No More “Fourbucks”

You knew this one was coming. Yes it is delicious and convenient to go through the local coffee shop drive thru, but it costs a lot of money. If you really want to save money, wake up and smell the home-brewed coffee! Add a flavored coffee creamer to your own coffee or make your own! At $4 a cup twice a week, you would be saving yourself $32 each month. That can go to your grocery budget (something you know you have to account for each month)!

Find 50 items to cook from scratch!

Learn to DIY

It used to be that if anything went wrong with your car or appliances you had no other choice but to call a repairman. There is a better way to fix some things and save money: It’s called YouTube. If the blinker light goes out on your car, look up how to replace the bulb on YouTube. There is a video out there for almost anything and it would be wise to check there before you call the handyman.

Several options to watch tv and movies absolutely free!

Invest in Quality Time at Home

It seems that every parent I speak with nowadays is running nonstop. We want to give our kids opportunities that perhaps we never had. But, it does help with life just to slow down and invest in some quality time at home that doesn't have to cost a dime. That may only be a few hours every night, but make those hours count by making popcorn and watching a movie together or spend time reading or playing games. This is low-cost time well spent.

My favorite advice goes back to the past……… If you don’t need it don’t use it. If you can repair it instead of replacing it spend a few minutes fixing it instead of wasting money on a new one..

I darn holes in socks if needed (now if they are getting bare we replace them of course) etc. You might as well get your money out of it I say.

Use up your leftovers don’t toss them. If it isn’t enough to feed everybody then save it for a stew. I keep a freezer bag in the freezer and add vegetables to it for a stew on the weekend. If your food does go bad compost it if possible at least it isn’t a total waste.

Just use common sense which is something people have lost over the years. If it is nice outside open the windows and turn off the air. We don’t turn on our air until it gets uncomfortable in the house. Sometimes a ceiling fan works instead of the air conditioner.

Don’t expect to run around the house in a tank top and shorts in the middle of winter and expect to be warm. Put on some clothes and turn down the heat.

Save money, pay off debt (we are doing it) and life will be much happier believe me.

I like the tip to adjust withholding. I think most people use this to their disadvantage, looking to get a refund. But this is really just an interest-free loan to the government. We try to come out about even on our taxes and use or save the money during the month.

Sarah, this is so true!! Since I don’t receive an interest-free loan from them, I’m not about giving them one either :) I prefer to take the small amount – even if it’s $10 – and add that directly to a savings account instead for the very reason you said.

How do I know how much I can claim so that I’ll come out close to even? I always just claimed nothing to be safe because I just didn’t know. Wish I would have taken a financial literacy class.

Here’s a trick that my mom and I have come up with (ok, now that I am 49 years old, I have rediscovered a great friendship with my mom, which is a whole story all it’s own) it doesn’t have to be your mom, it could be your sister, your best friend, but I’ve found the best disciplined way to make this work is to make it someone who does not live with me (and will not give in if I beg LOL)

My mom is retired, on a fixed income, gets paid once a month. I work full time, get paid every other Friday. At some point in time, we realized we both had a pattern of paying our bills when we got paid, then splurging a bit, then buying all the “required” stuff (gas, groceries, etc.) but always ran short again on “spendable” money, just a few days before payday (by “spendable, I mean without dipping into long term savings or frivolously using credit cards, we just don’t have any money left to play with for like an unexpected garage sale, a short notice birthday gift, etc).

So…….on my mom’s once a month payday, she gives me $100.00 to hold for her, and on each of my two Friday paydays, I give my mom $50.00 to hold for me. We don’t give/get it back until two days before the next payday. And as for as long as we’ve been doing this now, you’d think we’d just learn to bank on that money, but we get busy, side tracked, whatever….but it’s always a thrill when we get that $50 or $100 bucks just days before payday! Some people are really disciplined and can just do it on their own, but for us, we’ve found it’s the best way that works, so maybe you will want to give it a try!

The other thing we both do, since my sister is the BEST at saving money, is we give her anywhere from $25 to $100 at a time when it’s extra, and she locks it away for us until November, to save for Christmas shopping. And unless it’s a true emergency, she is excellent at not giving into early begging for it. Some banks now have “Christmas funds” that work the same way, but again, this is what works for our family.

Tanya, great ideas! Thanks for sharing them with the community here!!