Use Your Coupon Savings to Pay Off Debt

The following Best Savings Tip comes from reader, Bradi:

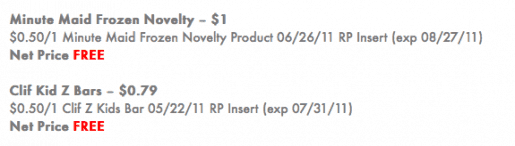

My husband and I used to spend $150 a week on groceries. We now spend closer to $50 – sometimes even less with the use of coupons. We take things a step further though and 1) only eat out when we have a coupon, 2) buy clothes on clearance or with a coupon, 3) make some of our own products rather than buying them, and 4) have recently started conserving electricity.

All of these saving really add up (I keep track of it on a spreadsheet). For some time now we have been putting our extra savings towards paying off our debts. I know this is something people know they should do, but most people still don't realize how much they can really save.

In a year we were able to pay off the remaining balance on a truck (about $7000). And, did you know that if you have a $200,000 home loan and make an extra $1000 payment (about $84 a month) each year that shaves almost 5 years off the life of your loan?!

We like doing a combination of things to pay off debt faster. We pay an extra amount per month while also saving as much as possible in our own account and then making extra “chunk” payments. We've paid off four cars and my husband's student loans this way. We only have two debts left and I'm not even 30 yet!

– – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

Way to go!! The little savings DO really add up and you're proof of that!

What have you done to reduce debt or save more? Share it today!

Your tip may inspire someone to start saving more and achieve their financial goals!

Catch up on all the Savings Tips shared to date.