Free Budget Spreadsheet

Since I wrote about ways to find your money drains earlier in the week, I wanted to share a budgeting spreadsheet with you that our family has personally used for years (and years).

Since I'm a lover of excel and google drive, the FREE Budgeting Spreadsheet is offered in Google Sheets for you to use in Google Sheets or use in Excel. I personally prefer Google Drive because I can access the document from anywhere. Just enter your information in the form below and you will get the link to the spreadsheet immediately.

How to Make a Budgeting Spreadsheet

This blog posts walks through the different elements in a budgeting spreadsheet. If you don't like the one we are offering for free, then these are important pieces to include your own budgeting spreadsheet because it's all about how much you're brining in with income and how much is going out with the expenses and discretionary spending.

This Budgeting spreadsheet is what my husband and I use to monitor our budget. We can edit it together since it's saved in Google Sheets so it's what I consider “fluid” and constantly being reviewed. Let me walk through the spreadsheet so you can see how we personally use it.

Budgeting Template for Google Sheets

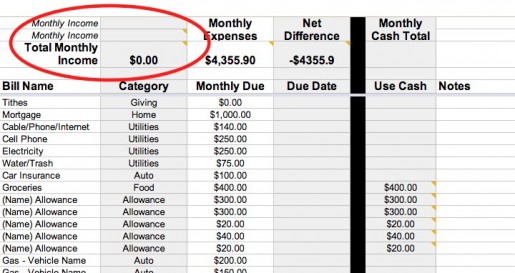

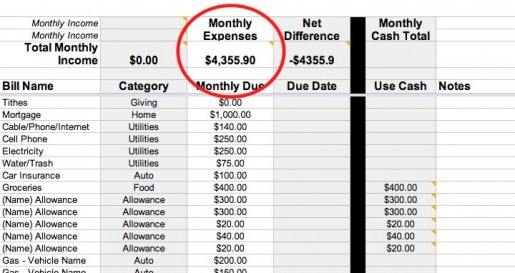

I know there are many free budget spreadsheets available but I wanted to personalize mine in order to help us achieve our financial goals. As you will see in the very top, I have two line items where you add your Monthly Income. I deliberately have these separate in case you and a spouse are working but want to eventually become a one-income family. More on that in a minute.

How to Budget

The bulk of this spreadsheet are your expenses and getting a good picture of what you are paying out each month. I'll explain as follows:

Bill Name

List the name of your bill. I keep mine as generic names rather than saying “XYZ Bank.” The names listed are purely for example and that's why a spreadsheet you can download yourself is much nicer than a PDF or printable since you can customize it for your family.

Category

I list a category. This isn't really necessary but it's interesting to get a picture of what categories are hogging up your money much like the online program Mint does for you. I use this mainly for planning.

Monthly Due

Enter the monthly total due to this bill name. You can see in the example, I have several items listed that most likely you use each week (Groceries, Gas, Allowance, etc). You want a monthly total here so you can understand how much you have to work with after all of your bills are paid.

This is another reason a spreadsheet is nice to have for a budget. You can easily see where the “fat” is and make adjustments quickly all while the formulas do the math for you.

Due Date

Kind of nice to know when things are due. This could be helpful to sort by if you get paid bi-weekly and want to make sure you have the funds in the bank to pay your bills on time.

Use Cash

Now this is one that I added 2 years ago when Paul lost his job unexpectedly. I wanted to use cash for some purchases but not go entirely cash-only. That's where I don't agree with Dave Ramsey's model. :) I'm not going to walk into a gas station and pay for my gas. That actually takes me time. Since I believe time = money, it's costing me by doing so. We use our debit card for these types of purchases so in my world, it's just like cash.

For those categories that I really want to stick to the budget though, cash is perfect! For example, our boys are motivated by cash so they like to have that versus and IOU (although I have done that before). Also, with entertaining and a bazillion sporting events to attend, we need cash. I use this column to help me total up how much cash I need to withdrawal from the bank each month so I can make one trip.

Notes

Just enter anything you may want to remember about this bill. Perhaps you are paying off a credit card and you want to add your balance here as motivation. Use it as you see fit (or you can delete it if you want too – up to you!).

Cash Flow Budget

After you enter your bills and totals, you will see the Monthly Expenses total update to reflect all of the totals listed in the Monthly Due column. That's the beauty of excel and Google Sheets since the formulas do all the work for you :)

This total gives you an accurate picture of how much you are paying each month. It's really important to list every single expense you can think of during this process.

The Net Difference column right beside will show you what the difference is between what you are making (Total Monthly Income) versus what you are spending (Monthly Expenses). If you are negative, it's time to look at the expenses and see what can be cut.

There is no easy way to say that. Something has to get cut now in order to live within your means. The last thing you want to do is to continue to make the debt you already have even higher. You can find ways to earn additional income but I would work with what you have now and figure out how to spend less THEN go see how else you can find odd jobs to earn a little extra cash.

Zero Sum Budget

Back to my initial statement about your Monthly Income and the two line items. When we were trying to figure out if we could be a one income family many years ago, I would use this same spreadsheet so we had a good picture of what we were spending. I would then delete one of the monthly income entries so we could see how things looked with just ONE income.

Our goal was for me stay home with our boys and we needed to make it work. I then started to rework the spreadsheet with a different viewpoint and deleted “my” Monthly Income line item. I needed to see if one income could cover all of our expenses.

As we were trying to make me being home with our kids a reality, we were paying off our debt at the time. I not only needed to ensure we could live on one income, I also wanted to ensure we had money “left over” so that we could apply additional payments to our debt payoff goal.

Sinking Funds

We wanted the debt gone as quickly as possible! We would put any extra money, aka sinking funds, towards one of the debts. When our debt was paid off, that extra money that wasn't needed for expenses would be set aside into various savings accounts so we were being proactive with upcoming purchases.

Definition of Sinking Funds

You will see many finance professionals refer to this extra money as Sinking Funds.The technical definition of sinking funds is:

“a fund formed by periodically setting aside money for the gradual repayment of a debt or replacement of a wasting asset.”

So while we were in the debt repayment phase, I always considered it just that: debt repayment. We have moved through many phases over the years and now have many longer-term goals, but we do have a few short-term goals we're saving for as well. Some short-term examples of sinking funds are things like:

- Property taxes for our home, paid annually.

- HOA fees, paid annually.

- Car for our soon-to-be-16-year old son, monthly savings for a specific goal amount.

- Kitchen remodel, monthly savings for a specific goal amount.

Many people simply refer to the sinking funds as savings because that's typically what the money is in reality. UNLESS, the funds are invested into a money market, bonds, an IRA, 401(k) or other type of investment accounts. With those accounts there are typically rules about how you can access the funds again without incurring a fee. The majority of our sinking funds now are for longer-term things like investments.

Cash Budget Example

Back to the budgeting. Since you will want to make this personal for your family, I would suggest you play around with creating what your actual budget should be. You can duplicate the tabs and have different budgets depending on how intense you want to be about your debt repayment or savings (aka sinking funds) goals.

I would do this a LOT as we were in the trenches of paying off our debt. I know Dave Ramsey suggests we be “gazelle intense” but that doesn't always work for everyone and it wasn't going to work for our family. But there were definitely expenses that weren't necessary, cable was one of those for us. Maybe you could go without it too? If you can cut cable when you are a one income family then what's stopping you from cutting cable today?

The same goes for lowering your Christmas budget, finding a new cell phone provider or reducing your grocery bill? They all add up! Do those things BEFORE you make the official change to live on one income and you will have that much more saved. I sure wish we would have done that!

I cover a lot more on how to start a cash budget here.

Why Budgeting is Important

Budgeting was so very important to the financial freedom that we have today! I'm not exaggerating when I say this spreadsheet is also how we made it happen – it absolutely works if you work it! I hope you find this spreadsheet as useful as we have in managing our finances.

We are raising our boys to save as much as they can while they're still young. Our 15-year old son has a job and he saves the majority of his paycheck. Our 23-year old son graduated college and has his first “real” job so he basically saves his entire check (he had no college debt since he was a student athlete on scholarship).

Whatever your financial goals are this year, and beyond, have them written down and PLAN for the future. We all have enough issues with the things out of our control (hello inflation!!) and an annual bill that happens EVERY year shouldn't be a surprise or cause you to dip into your emergency fund to cover the bill.

I plan to add more resources like this to the lineup of what we share here. My goal is to provide tools and information to help you live a lifestyle of saving!

More tips for How to Save Money and Budget

52 Week Money Challenge Excel Template

Envelope Method of Budgeting: The Cash Envelope System Explained

Money Saving Challenges Worth Trying

I should add the disclaimer that I am NOT a financial planner and don't play on one the internet either. However, we HAVE paid off a LOT of debt (nearly $200k when we were in the thick of debt payoff mode), our home is paid off and we have saved and sacrificed to have cash to pay for our current vehicles. All of that to say that even though I'm not a professional, I know how to manage our family finances well enough to get something positive done and YOU CAN TOO! :)