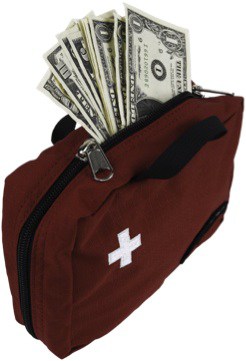

Use an FSA to Reduce Your Federal Income Taxes

The following Best Savings Tip comes from reader, Vickie:

I have worked in the Health Insurance Industry for years and know that too many employees do not take advantage of the Flexible Spending Account (FSA), offered by their employer. It's a benefit that allows you to have money taken out of your paycheck on a pre-tax basis to cover the costs of out-of-pocket expenses for medical, dental and vision benefits. Because it's taken out on a pre-tax basis, it reduces your Federal Income Taxes.

You have to pay for out-of-pocket expenses anyway, so you might as well take advantage of reducing your taxes. Take the time to understand this benefit, and start reaping the benefits.

– – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

Great tip, Vickie! We always enroll in the FSA each year to help offset out of pocket expenses like co-pays, RX's and dental visits. In fact, when we had Andon's surgery expenses to pay for, we had an FSA and that was a HUGE help!

Do you have an FSA?

Do you have a tip that helps you save? Share it on the Best Savings Tip page!

Your tip enters you into into the $1000 in cash prizes!

Catch up on all the Savings Tips shared to date. Ya'll amaze me!